Teach Accounting with Confidence

This article makes practical suggestions for introducing a powerful and effective learning system into your teaching. Accompanying the article is free access to the Accounting Cafe online course “Teach Accounting with Confidence”.

The Colour Accounting Learning System

The Colour Accounting Learning System is used in workshops for senior business leaders with no prior financial education or training, to help them get to grips with accounting fundamentals. The system is rooted in practice and commercial training and has been delivered many thousands of times across the world.

Importantly, it has intellectual, conceptual and academic rigour and Toby York has been using this system at the University of Middlesex teaching undergraduates and entrepreneurial postgraduates for the past 5 years. This article explores its value as an educational method for teachers of Unit 3 on the BTEC Nationals in Business and in Enterprise & Entrepreneurship.

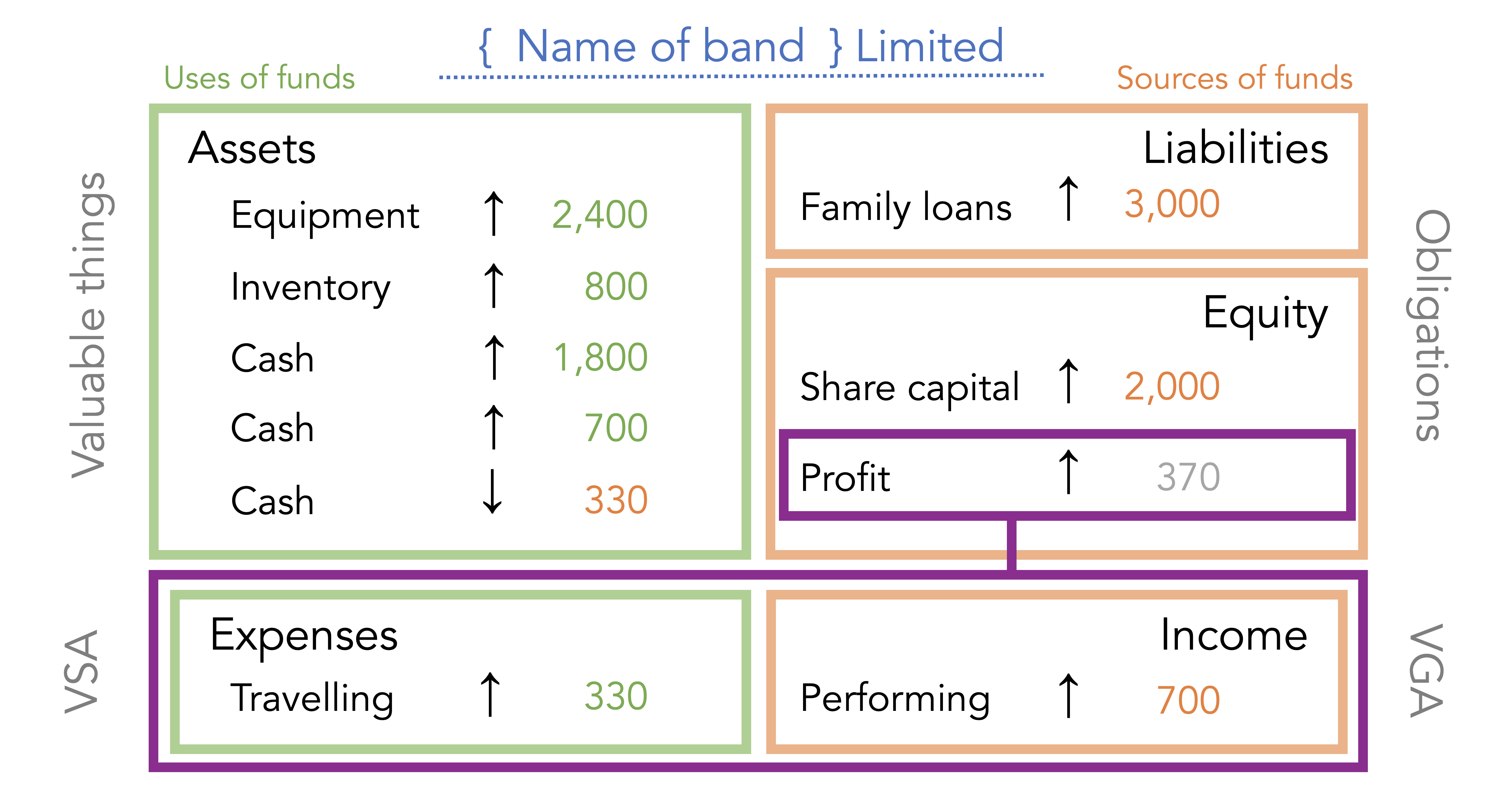

The Colour Accounting Learning System uses a concept map—referred to as the BaSIS Board (derived from “Balance Sheet and Income Statement”)—which provides a visual representation of the accounting framework that your learners can use to acquire and organise their knowledge.

It enables learners to understand the effects of transactions and their context within the accounting framework. The same visual language and schema are being used by the teacher and learners which makes the transfer and accumulation of knowledge faster and more secure.

The BaSIS Board uses colours to represent the two sides of the accounting framework—green for uses of funds (assets and expenses) and orange for sources of funds (liabilities, equity and income)—and additionally, it uses the same colours to demonstrate the increasing and decreasing effects of transactions on the accounting framework—in the picture above this is shown by the coloured numbers. The same colour is used for increasing effects: a green number in assets indicates an increase in assets. The opposing colour is used for decreasing effects: an orange number in assets indicates a decrease in assets.

The importance of sequencing

Ofsted inspectors make judgements on the quality of education by evaluating the extent to which the curriculum is "coherently planned and sequenced towards cumulatively sufficient knowledge and skills for future learning and employment"

The proposed sequence in the Teach Accounting with Confidence course does exactly this. It starts with the statement of financial position. Don’t be put off by this. It makes a lot of sense. Here’s a quote from A.C. Littleton, a highly regarded accounting educator, writing in 1922:

“This approach is to be favoured because it aims ‘at the beginner's mind…’. It is directed toward the ‘whys’ of accounting…This approach also emphasizes the teaching of business…The principle of learning about the ‘whole’ and then proceeding to the parts….”

[Ofsted (2021), Education inspection framework, Available at: https://www.gov.uk/government/publications/education-inspection-framework/education-inspection-framework

A.C. Littleton (1922), An Appraisal of the Balance Sheet Approach, Papers and Proceedings of the Seventh Annual Meeting, American Association of University Instructors in Accounting, VII (1923), 85–92.]

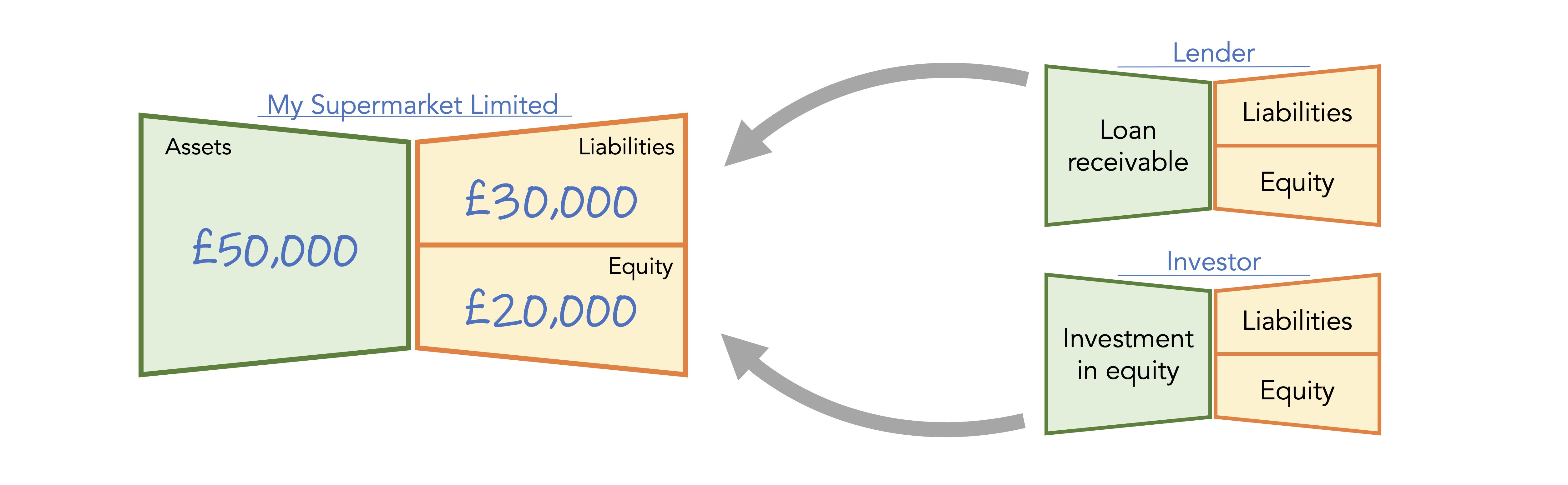

His reference to the statement of financial position as the “whole” is significant because all modern accounting is founded on the dual concepts of:

- property in a broad sense (that is, assets), and

- those who have a claim on that property (liabilities and equity).

Accounting is the process of arranging these two sets of facts side by side. The two sides are always in equilibrium because they are measured using the same monetary units. It’s why balance sheets balance; not by magic, but as an expression of accounting’s natural, internal logic.

Let’s unpack this a little by walking through the first few suggested lessons.

Lesson 1: Assets

The first lesson explores assets: their nature and how they are classified. It’s a broad and enjoyable conversation, drawing distinctions between “assets in financial statements” and “assets in the world”. This introduces learners to the arbitrariness of accounting rules in a very accessible way.

Lesson 2: Liabilities and equity

The second lesson introduces liabilities and equity as sources of funding for assets. It sets out an important principle: there are only two sources of funding—liabilities and equity.

Learners quickly become familiar with the terms and the accounting equation becomes an obvious statement of fact, rather than a formula to be learned:

Assets = Liabilities + Equity

It clearly makes sense to teach sources of finance after this introduction.

Lesson 3: Putting things together

The next lesson consolidates understanding—learners are invited to imagine a story of four young people forming a band. They use the BaSIS Board to show the accounting effects of four transactions:

- Borrow funds from family (liabilities).

- Band members invest their own funds (equity).

- The band buys equipment (assets).

- The band buys inventory (assets).

Lessons 4 and 5: Income and expenses

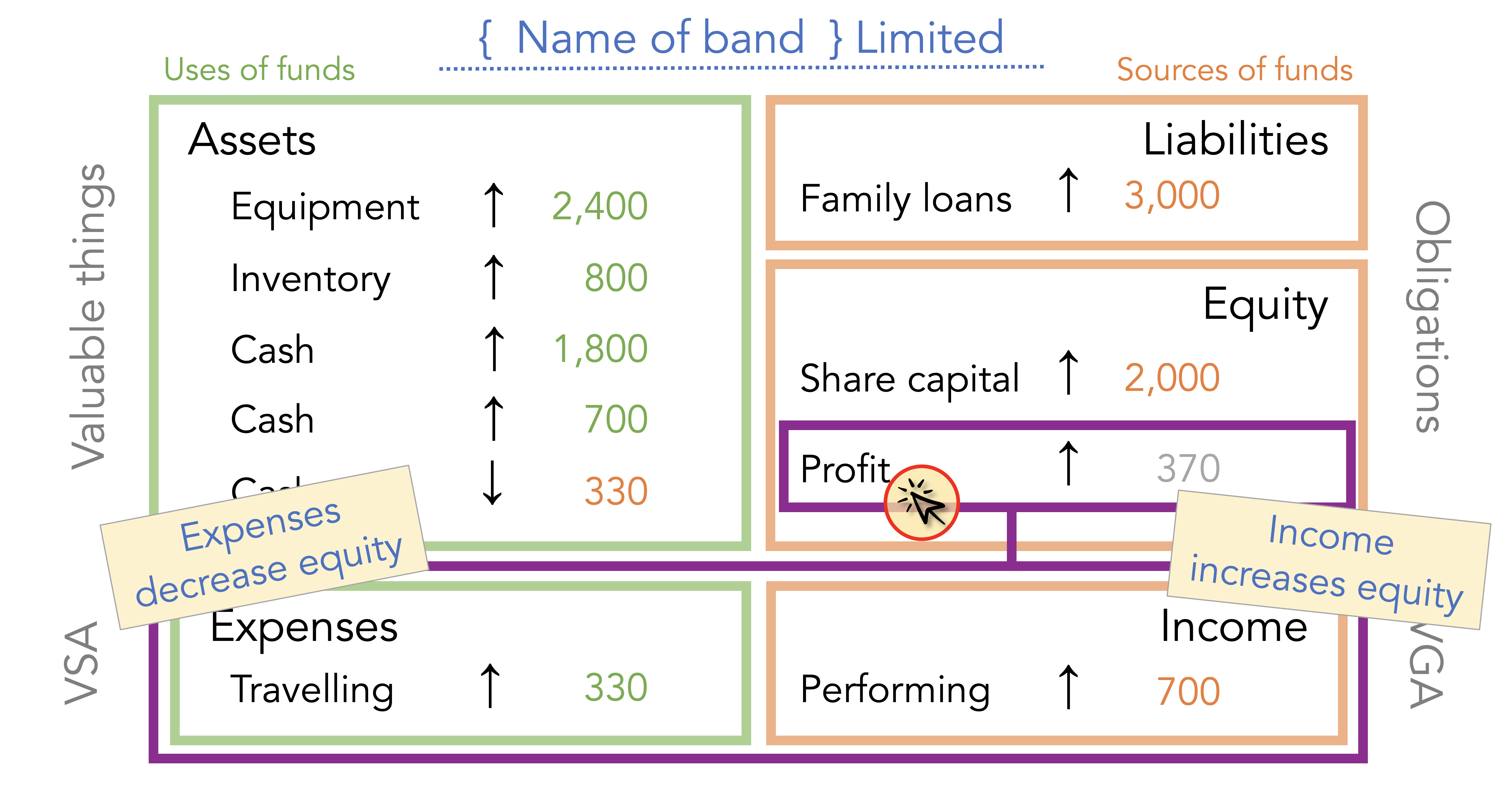

It is only in the fourth lesson that the concept of profit is introduced. The BaSIS Board shows learners that profit is a type of equity: “generated equity”, (as opposed to equity introduced to the business: “share capital”).

Two more transactions are added to the story of the band:

- The band performs its first gig (income). [Lesson 4]

- The band sells some merchandise (income and expenses). [Lesson 5]

These six transactions form a bedrock of conceptual knowledge that will carry learners through the rest of the syllabus. This sounds like an extravagant claim, but it’s true.

Altogether these first five lessons arm learners with a solid foundation and an incredibly powerful tool for learning.

Realising that profit is a part of equity is an “a-ha” moment for many learners, so we dwell on this and let it sink in. It’s another very good reason to start with the statement of financial position, or this essential fact can easily be overlooked.

The next steps are important, and in classes we suggest progressing slowly, enjoying the opportunity to explore the natures of income and expenses.

We reveal income and expenses on the BaSIS Board by “double-clicking” the purple profit box, a bit like a folder on a computer.

Learners discover that income increases equity and expenses decrease equity. This is explored again when the statement of profit or loss is introduced. The learner sees that the statement of profit or loss explains how generated equity changed during an accounting period.

The statement of profit or loss is a part of the whole,

and the whole is the statement of financial position.

The Teach Accounting with Confidence (TAWC) course

Earlier this year, we piloted a series of after school training sessions for teachers to demonstrate how the Colour Accounting Learning System works for Level 3 teaching.

Recordings of those sessions are available now, free of charge, on the Accounting Cafe website. You can also download detailed lesson plans, editable presentation slides, teaching notes, activities and handouts, which if used as suggested, are enough to support approximately 47 lessons.

The last topic of the course adapts the Colour Accounting Learning System to personal finance. Again, we stress, personal finance is therefore better taught after business finance. It applies to aspects of personal finance specifically relevant to Topic A4 of Unit 3.

| Topic | Title | Content |

|---|---|---|

| 1 | Level 3: Fundamentals of accounting | 1. Introduction to the Colour Accounting System 2. Level 3 Foundations: Financial statement elements. (The first five lessons described above) |

| 2 | Non-current assets (40 minutes) | 1. Statement of financial position 2. Depreciation 3. Sale of non-current assets 4. Introducing the “discuss” command verb |

| 3 | Statement of financial position (40 minutes) | 1. Statement of financial position 2. Current assets and current liabilities 3. Liquidity ratios 4. Puzzles |

| 4 | Gross profit and expenses (60 minutes) | 1. Income and expenses 2. Gross profit: “Seasons” 3. Gross profit and gross profitability 4. Cost of sales |

| 5 | Statement of Comprehensive Income (SCI) (60 minutes) | 1. Statement of Comprehensive Income (SCI) 2. SCI: examples 3. Using ratios to measure ‘efficiency’ 4. Efficiency ratios: examples 5. More ratios: Fabulous Frames 6. Forecasting: Fabulous Frames 7. Creating financial statements using spreadsheets 8. Calculating ratios using spreadsheets |

| 6 | Sources of finance (60 minutes) | 1. Re-cap of the accounting framework 2. Funding net current assets 3. Debt factoring and invoice discounting 4. Venture capital and other sources of finance 5. Leasing and sale of assets 6. Practise exam questions |

| 7 | Cash flow forecasts (45 minutes) | 1. Introducing cash flow forecasts 2. Cash flow forecasting using the BaSIS Board 3. Cash flow forecasting using columns by month 4. Efficiency ratios revision 5. Uses and limitations of forecasting 6. Applying forecasting to ‘evaluate’ questions |

| 8 | Break-even analysis (30 minutes) | 1. Break-even (no profit and no loss) 2. Using break-even charts 3. More examples and limitations of break-even 4. Review lesson: answering ‘analyse’ questions 5. Plotting break-even using spreadsheets |

| 9 | Personal finance (60 minutes) | 1. Introduction to personal finance 2. The power of compounding 3. Different ways to borrow 4. Different ways to save and invest 5. Pensions 6. Insurance policies |

The intention Is not to teach you accounting. Rather, it is to set out an approach to support your teaching and help you to see the teaching of accounting differently using a learning system with a proven pedagogy.

Links

- 1. The first step Is to create an account:

-

2. Level 3 Fundamentals of accounting

This includes an explanation of the pedagogy.

- 3. BTEC: Teach Accounting with confidence:

The Basis Board is owned by Wealthvox Limited and is licensed under CC BY-NC-SA 4.0 Attribution-NonCommercial-ShareAlike 4.0 International.

Additional materials were developed by Colin Leith, Toby York and AccountingCafe.org. The additional materials are also licensed under CC BY-NC-SA 4.0 Attribution-NonCommercial-ShareAlike 4.0 International.

These licenses require that re-users give credit to the creators. Re-users are allowed to distribute, remix, adapt, and build upon the material in any medium or format, for non-commercial purposes only. If others modify or adapt the material, they must license the modified material under identical terms.

-

To view a copy of this license, visit Creative Commons.

These freedoms cannot be revoked as long as you follow the license terms.

Corporate logos and company names are used under fair dealing provisions within the guidelines of the Intellectual Property Offices’ Exceptions to Copyright for Education and Teaching.

Toby York is a chartered accountant, Senior Lecturer at Middlesex University and founder of AccountingCafe.org.

A version of this article first appeared in the summer 2022 edition of Teaching Business & Economics (the journal of the EBEA, the Economics, Business and enterprise Association)

Subject advisor

Colin Leith

Business